slowmotiongli/iStock via Getty Images

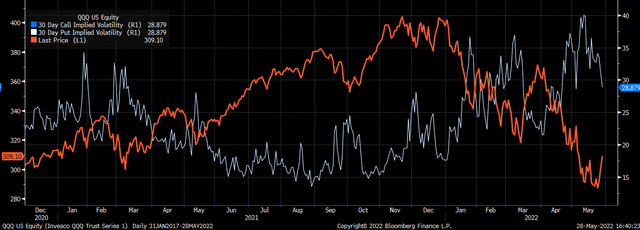

It was undoubtedly an explosive week for the Invesco QQQ ETF (NASDAQ:QQQ), which jumped by 7%, echoing the March rally. Moves of this size certainly get many people excited. But let’s face facts, nothing changed this week for the QQQ’s outlook, just that it finally rallied after dropping for seven weeks in a row.

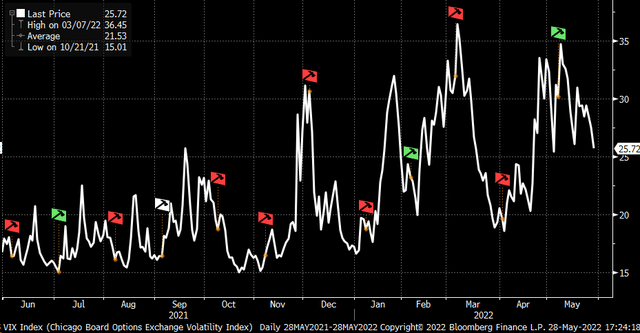

The only good thing for the QQQ was that the Fed minutes didn’t reveal anything new. That helped push implied volatility levels down across the market, leading to the frenzied buying spree. But from the weight of the evidence, the QQQ and the NASDAQ rally would appear to be nothing more than a mechanical bounce due to implied volatility unwinding.

Bloomberg

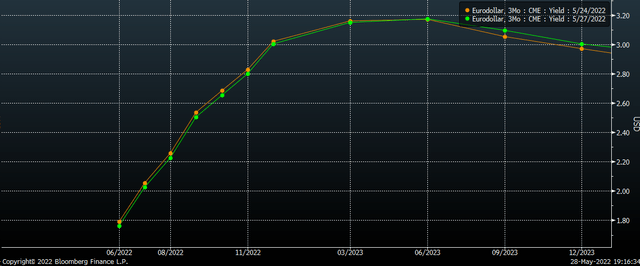

Rates didn’t seem to have any opinion on the FOMC minutes and instead stayed pretty much unchanged following the release. Eurodollar futures saw no material change in the path of future rate hikes from where they stood on May 24, the day before the Fed Minutes, and their close on Friday, May 27.

Bloomberg

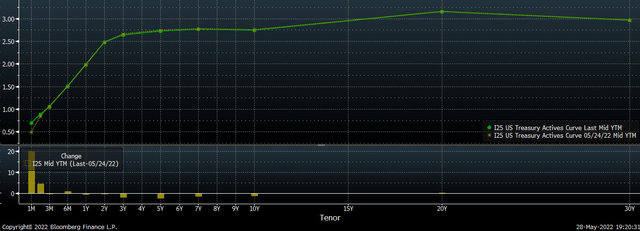

There was also no noticeable change in the Treasury yield curve following the release of the Fed minutes either. So, if there was a dovish surprise within the Fed minutes, the interest rate market certainly did not pick up on that change in tone.

Bloomberg

It leaves one to conclude that the rally in the equity market and the QQQ was a de-risking event that led to implied volatility moving lower into a long 3-day weekend. It means there is a good chance that come Tuesday, hedges will start to be placed, and implied volatility will begin to move higher again.

Is it possible for the buying frenzy in the QQQ and the stock market to carry on for a few more days or even weeks? Sure. But it depends on how the markets view volatility next week, after the long holiday weekend. Suppose investors begin to feel complacent about the path of monetary policy. In that case, the demand for protection could drop further, pushing implied volatility down, which can help boost the QQQs further.

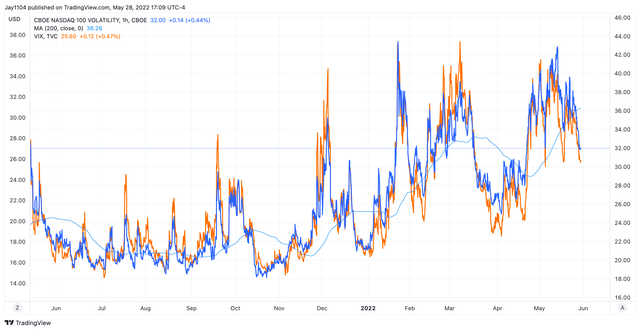

The NASDAQ 100 volatility index is the VXN, which is equivalent to the VIX. It is just that the VIX measures implied volatility in the S&P 500. The two closely follow each other, so I will use the VIX moving forward since it is more widely known and followed as the measure of implied volatility.

TradingView

The VIX, since the beginning of May, has found itself bottoming around the 25 to 26 level. It makes that 25 to 26 region critical; if the VIX continues to push lower heading into several macro data points this week, like the ISM manufacturing PMI and the BLS job report, there is a very good chance the market can rally further. However, if the VIX starts to push above 30, then all of the gains from this past week will vanish.

There is a good chance the VIX will rise again this week. Beginning in December, the job report has become much more critical for the market, as noted by the VIX. The December, March, and May jobs reports showed that the VIX was at the upper end of its trading range. Meanwhile, January, February, and April reports found the VIX lower.

Bloomberg

The fluctuations in the VIX could be because the FOMC meeting in January had very low expectations for any policy shift, while there was no FOMC meeting in February. Additionally, like the other months, the April job report had little importance since there was no FOMC meeting. June will feature an FOMC meeting, which probably means there will be significant importance on this Job report, which could be enough for traders to look to put hedges back in place into this week’s report.

Not only do these factors present challenges for a sustained long-term rally, but we must remember what the Fed wants, which is for inflation to come down sharply. The Fed wants financial conditions to tighten, and if it views financial conditions as easing too much, the Fed is likely to step up its rhetoric and start jawboning the market back to where it wants. This would mean that financial conditions are heading towards neutral and potentially restrictive over time based on how the Fed minutes read. That is what poses the most significant risk to the QQQ, and it will make fighting the Fed a challenging task.

from Stock Market News – My Blog https://ift.tt/ScyR9b6

via IFTTT

No comments:

Post a Comment